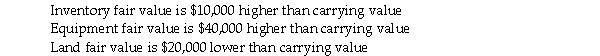

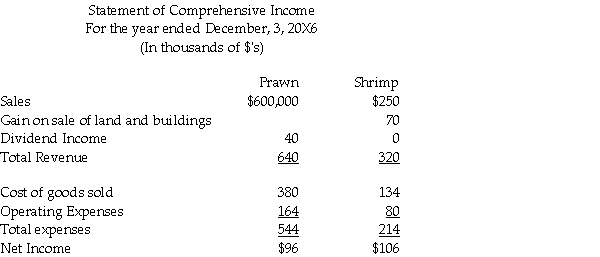

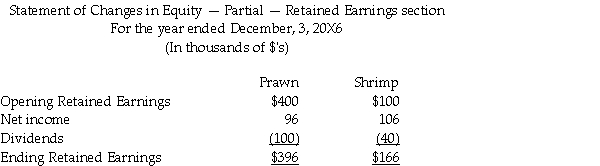

Prawn Corporation owns 80 percent of the outstanding voting shares of Shrimp Corporation,having acquired its interest January 1,20X3 for $100,000.At the time of the acquisition,Shrimp Corporation had a shareholder's equity totalling $150,made up for retained earnings of $30,000 and common shares of $20,000.The following accounts had fair values higher (or lower)than its carrying values:

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill.

The balance of the land and buildings at December 31,20X6 for Prawn totalled $895,000 and for Shrimp totalled $450,000.

Additional Information:

1.Shrimp had reported $50,000,relating to land (40%)and building (60%)sold to Prawn on January 3,20X5.These separate properties had not been owned on January 1,20X3.Remaining useful life was expected to be 10 years at that time.

2.Shrimp sold other land to a non-related company at a gain of $20,000 on June 30,20X6.

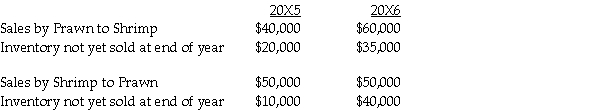

3.Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Calculate the following consolidated balance as at December 31,20X6:

a.Retained earnings

b.Land and Buildings

Definitions:

Performing Stage

The phase in team development where group members efficiently work together and focus on problem-solving and task completion.

Problem Solving

The process involved in finding solutions to difficult or complex issues.

Performing Stage

This is typically referred to as a phase in team development where the group operates efficiently towards shared goals with strong structures and cohesiveness.

Team Cohesiveness

The extent to which team members are attracted to the team and motivated to remain part of it, often resulting in improved performance and morale.

Q13: Which of the following covenants would not

Q16: TLC Homecare Ltd.owns 100% of Errand Service

Q17: On December 31,20X5,Paper Co.purchased 60% of the

Q32: Fransen Co.does a lot of businesses in

Q40: For a not-for-profit organization,an expenditure is _.<br>A)any

Q96: Which of the following describes the term

Q98: of the following are departments in a

Q123: respect to the history of American business,the

Q130: A $20,000,3-month,8% note payable was issued on

Q152: FUTA (federal unemployment compensation)tax is paid by