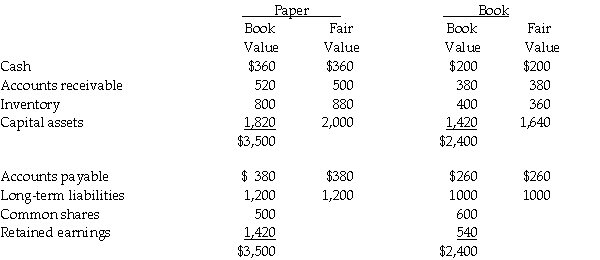

On December 31,20X5,Paper Co.purchased 60% of the outstanding common shares of Book Ltd.for $760,000 in shares and $200,000 in cash.The statements of financial position of Paper and Book immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1e_8673_17bfb9e70ca1_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e1f_8673_3fd87744d883_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1099_7e20_8673_0766af66919c_TB1557_00

Required:

Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7.

Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income.s) Required: Paper has determined that it does not have control but only has significant influence over Book.Calculate the balance in the investment account at December 31,20X7. Calculate the investment income from this investee for 20X7 that Paper would show on its statement of comprehensive income." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)