Bowen Limited purchased 60% of Sloch Co.when Sloch's reported retained earnings of $330,000.Bowen also owns 80% in Zeek Limited,which was purchased when Zeek reported retained earnings of $575,000.For each acquisition,the purchase price was equal to the fair value of the identifiable net assets which was the same as the carrying value of their carrying values.

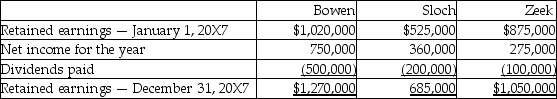

An analysis of the changes in retained earnings of the three companies during the year 20X7 gives the following results:

Sloch sells product to Bowen that is used in Bowen's production.Bowen will then sell part of its products to Zeek.

Intercompany profits included on sales from Sloch to Bowen were $25,000 included in January 1,20X7 inventory and $40,000 included in December 31,20X7 inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1,20X7 inventory and $35,000 included in December 31,20X7 inventory.

During 20X5,Bowen sold a building to Zeek for a gain of $300,000.The building had a remaining life of 25 years.During 20X7,Sloch sold a building to Bowen for a gain of $75,000.This building has a useful remaining life of 15 years.Full depreciation has been recorded in the year of acquisition by each company and no depreciation is recorded in the year of sale.

Required:

Calculate the consolidated net income for the year ended December 31,20X6.Determine the allocation between the NCI and owners of the parent.

Definitions:

Debit Balance

Occurs when the amount paid is less than the total due.

Credit Balance

The amount of money in a financial account that is available for withdrawal or use, exceeding what is owed.

Business Associate Agreement (BAA)

A contract between a healthcare provider and a business associate that handles protected health information (PHI) to ensure the associate will protect the PHI in compliance with HIPAA regulations.

Protected Health Information (PHI)

Any information within the healthcare setting that can be used to identify an individual and that was created, used, or disclosed in the course of providing a healthcare service, such as diagnosis or treatment.

Q1: When a subsidiary issues shares,_.<br>A)no gain or

Q5: At the beginning of 20X1,Anwar Ltd.acquired 15%

Q5: On December 31,20X2,the Esther Company purchased 80%

Q16: Which of the following correctly describes Interest

Q17: FICA tax is a tax which is

Q20: On January 1,2013,Davie Services issued $20,000

Q31: ABC Company signed a 5-year note payable

Q36: Which of the following is the amount

Q69: Associated Foods had cash sales of

Q118: On November 1,2013,Archangel Services issued $200,000