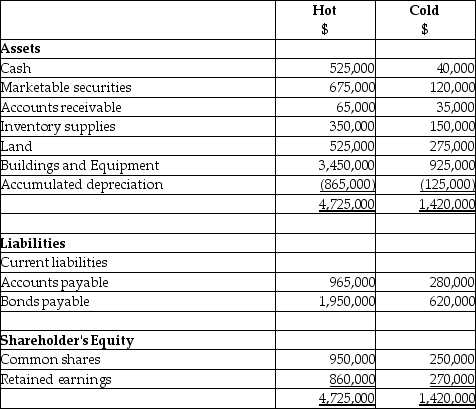

On September 1,20X5,Hot Limited decided to buy 80% of the shares outstanding of Cold Inc.for $850,000.Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,Hot determines that some of the assets of Cold have fair values different from their carrying values.These items are listed below:

• Inventory has a fair value of $130,000

• The building has a fair value of $1,090,000.The remaining useful life of the building is 20 years.The accumulated depreciation on the building at the time of acquisition was $50,000.

• A trademark has a fair value of $300,000.The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due in August 31,20X9.

During the 20X9 fiscal year,the following events occurred:

1.Hot sold merchandise to Cold for $200,000.Profit margin on these sales is 30%.Cold still has inventory on hand of $70,000.Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000.The gross profit margin on these sales was 30%

2.Cold sold merchandise to Hot for $500,000.The gross margin on these sales was 40%.At the end of the year,$180,000 of this was still in Hot's inventory.Included in the opening inventory of Hot for 20X9 was merchandise purchased from Hot in 20X8 for $230,000.The profit margin on these sales had been 30%.

3.During 20X9,Cold sold to Hot equipment resulting in a gain to Cold of $75,000.At the time,the original cost and accumulated depreciation to date for the equipment on the Cold's books was: $510,000 and 160,000.The remaining useful life for this equipment is 15 years.Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4.During 20X9,Cold paid management fees of $450,000 to Hot.

5.During 20X9,Cold paid dividends of $400,000 and Hot paid dividends of $600,000

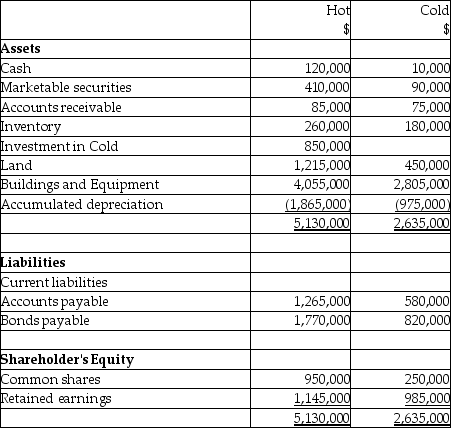

Statements of Financial Position

As at August 31,20X9

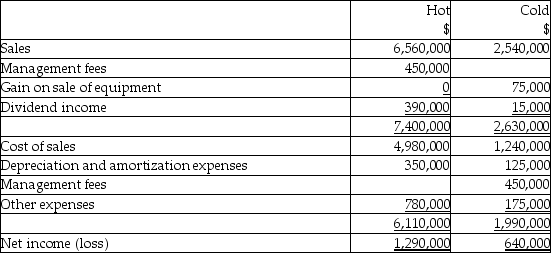

Statements of Comprehensive Income

For the year ended August 31,20X9

Required:

Prepare the consolidated statement of financial position for Hot as at August 31,20X9.Calculate the closing balance for the retained earnings and the non-controlling interest.The company used the parent-company extension method to determine goodwill for this acquisition.

Definitions:

Group Membership

The affiliation or inclusion of individuals within a group, which affects their identity and social interactions.

Social

Pertains to activities, behaviors, or phenomena related to the interactions and relationships among individuals within a society.

William James

An American philosopher and psychologist, often referred to as the "Father of American psychology."

Clothing

Items worn on the body to protect, adorn, or for cultural reasons, including garments and accessories.

Q6: The disbursement basis for recognizing resource outflows

Q30: What exchange rate is usually used to

Q33: On December 31,20X5,Space Co.purchased 100% of the

Q35: Which of the following accounting methods would

Q45: On March 1,20X2,McBride Ltd.issued a purchase order

Q69: If a bond's stated interest rate is

Q125: Premium on bonds payable is spread over

Q132: The current portion of notes payable must

Q196: college student is taking a full course

Q263: organization that focuses its efforts on: (1)continuously