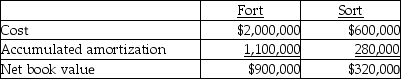

Fort owns 70% of the outstanding common shares of Sort.On December 30,20X3,Sort sold some equipment to Fort for $100,000.The equipment had been purchased by Sort for $120,000 in 20X2,had accumulated amortization of $30,000 and a six-year remaining life at December 31,20X3.Both companies record a full year of amortization expense for assets purchased in the first half of the year and no amortization on assets purchased in the last half of the year.Equipment for Fort and Sort on their separate-entity balance sheets at December 31,20X3 was as follows:

On December 31,20X6,Fort sold the equipment to an outside company for $65,000.What is the gain on sale of equipment to be reported on the consolidated income statement for the year ended December 31,20X6?

Definitions:

Reciprocal Determinism

a concept in psychology that individuals and their behavior are shaped by the interaction between personal factors, their environment, and their behavior.

Defense Mechanisms

Psychological strategies unconsciously used by individuals to protect themselves from anxiety and to manage emotional conflict and internal or external stressors.

Psychosexual Stages

A Freudian theory describing the stages of a child's development, each characterized by the erogenous zone that is the source of the child's psychosexual energy.

Fixations

Persistent focus on an earlier psychosexual stage due to unresolved conflicts, as per Freudian theory.

Q3: For private enterprises that have acquired goodwill

Q4: Bright School is a private school operating

Q5: On December 1,20X5,Gillard Ltd.sold goods to International

Q10: If a bond's stated interest rate is

Q21: What happens on July 1,2014?<br>A) Avery pays

Q30: Unearned revenue is an obligation to provide

Q46: Blanding Company issues $1,000,000 of 8%,10-year bonds

Q66: On January 1,2013,Davie Services issued $20,000

Q68: Pending federal legislation will require all online

Q105: Using the present value tables,please compute the