Bowen Limited purchased 60% of Sloch Co.when Sloch's reported retained earnings of $330,000.Bowen also owns 80% in Zeek Limited,which was purchased when Zeek reported retained earnings of $575,000.For each acquisition,the purchase price was equal to the fair value of the identifiable net assets which was the same as the carrying value of their carrying values.

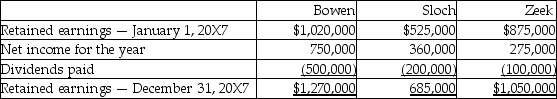

An analysis of the changes in retained earnings of the three companies during the year 20X7 gives the following results:

Sloch sells product to Bowen that is used in Bowen's production.Bowen will then sell part of its products to Zeek.

Intercompany profits included on sales from Sloch to Bowen were $25,000 included in January 1,20X7 inventory and $40,000 included in December 31,20X7 inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1,20X7 inventory and $35,000 included in December 31,20X7 inventory.

During 20X5,Bowen sold a building to Zeek for a gain of $300,000.The building had a remaining life of 25 years.During 20X7,Sloch sold a building to Bowen for a gain of $75,000.This building has a useful remaining life of 15 years.Full depreciation has been recorded in the year of acquisition by each company and no depreciation is recorded in the year of sale.

Required:

Calculate the consolidated net income for the year ended December 31,20X6.Determine the allocation between the NCI and owners of the parent.

Definitions:

Firm

A firm is an organization engaged in commercial, industrial, or professional activities, aiming to generate profits from its operations.

Risk-adjusted

This term describes the process of taking financial risks into account when evaluating the potential returns of an investment, leading to a more accurate understanding of its true value.

Discount Rates

The interest rate used to calculate the present value of future cash flows.

Risk

The possibility of losing some or all of an investment, reflecting uncertainty about the actual future returns.

Q1: Bowen Limited purchased 60% of Sloch Co.when

Q1: On September 1,20X7,CanAir Limited decided to buy

Q10: On March 1,20X2,McBride Ltd.issued a purchase order

Q13: A subsidiary sold goods to its parent

Q15: On November 2,20X9,Henry Company purchased a machine

Q17: Which of the following statements is true?<br>A)The

Q34: How does a company usually take a

Q45: Which of the following is a liability

Q106: Warranties pose an accounting challenge because a

Q159: The journal entry for accrued interest on