Bowen Limited purchased 60% of Sloch Co.when Sloch's reported retained earnings of $330,000.Bowen also owns 80% in Zeek Limited,which was purchased when Zeek reported retained earnings of $575,000.For each acquisition,the purchase price was equal to the fair value of the identifiable net assets which was the same as the carrying value of their carrying values.

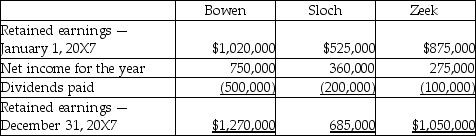

An analysis of the changes in retained earnings of the three companies at December 31,20X7 was:

Sloch sells product to Bowen that is used in Bowen's production.Bowen will then sell part of its products to Zeek.

Intercompany profits included on sales from Sloch to Bowen were $25,000 included in January 1,20X7 inventory and $40,000 included in December 31,20X7 inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1,20X7 inventory and $35,000 included in December 31,20X7 inventory.

During 20X5,Bowen sold a building to Zeek for a gain of $300,000.The building had a remaining life of 25 years.During 20X7,Sloch sold a building to Bowen for a gain of $75,000.This building has a useful remaining life of 15 years.Full depreciation has been recorded in the year of acquisition by each company and no depreciation is recorded in the year of sale.

Required:

Calculate the consolidated retained earnings and balance of the non-controlling interest as at December 31,20X7.

Definitions:

Percent Increase

The percentage by which a quantity grows over a specific period of time.

Mortgage

A loan used to purchase a property, secured by the real estate itself, typically paid back over a long term with interest.

Interest

The charge for borrowing money, typically expressed as an annual percentage rate.

ARM

Adjustable Rate Mortgage; a type of mortgage loan where the interest rate varies throughout the loan period based on an index.

Q3: Under IAS 27,where does the non-controlling interest

Q3: O'Ball Ltd.wants to acquire Kiro Ltd.to take

Q3: Faulk Ltd.has provided the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1557/.jpg"

Q7: Describe the four fundamental ways in which

Q15: Hattrick Corp.is a wholly owned,parent-founded subsidiary of

Q16: A government business enterprise's net income or

Q24: What is the most common valuation method

Q42: A local ice cream shop pledged 10%

Q63: want refers to<br>A) a sense of personal

Q103: Employer FICA is a tax expense that