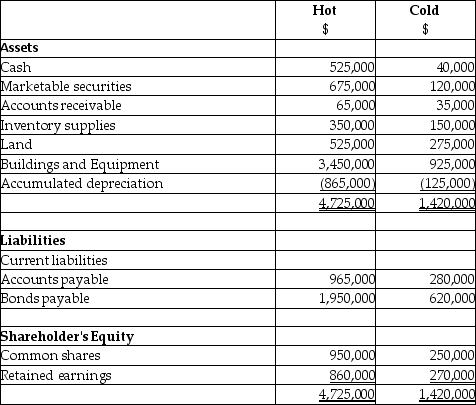

On September 1,20X5,Hot Limited decided to buy 80% of the shares outstanding of Cold Inc.for $850,000.Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,Hot determines that some of the assets of Cold have fair values different from their carrying values.These items are listed below:

• Inventory has a fair value of $130,000

• The building has a fair value of $1,090,000.The remaining useful life of the building is 20 years.The accumulated depreciation on the building at the time of acquisition was $50,000.

• A trademark has a fair value of $300,000.The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due in August 31,20X9.

During the 20X9 fiscal year,the following events occurred:

1.Hot sold merchandise to Cold for $200,000.Profit margin on these sales is 30%.Cold still has inventory on hand of $70,000.Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000.The gross profit margin on these sales was 30%

2.Cold sold merchandise to Hot for $500,000.The gross margin on these sales was 40%.At the end of the year,$180,000 of this was still in Hot's inventory.Included in the opening inventory of Hot for 20X9 was merchandise purchased from Hot in 20X8 for $230,000.The profit margin on these sales had been 30%.

3.During 20X9,Cold sold to Hot equipment resulting in a gain to Cold of $75,000.At the time,the original cost and accumulated depreciation to date for the equipment on the Cold's books was: $510,000 and 160,000.The remaining useful life for this equipment is 15 years.Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4.During 20X9,Cold paid management fees of $450,000 to Hot.

5.During 20X9,Cold paid dividends of $400,000 and Hot paid dividends of $600,000

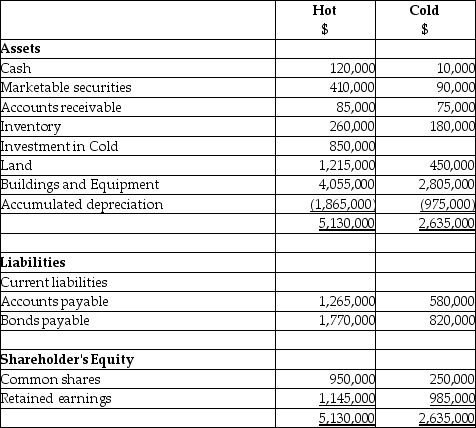

Statements of Financial Position

As at August 31,20X9

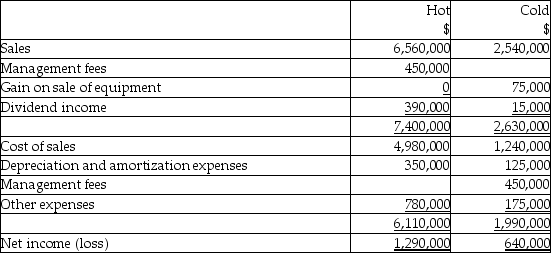

Statements of Comprehensive Income

For the year ended August 31,20X9

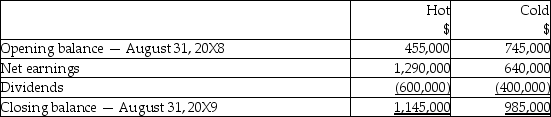

Statements of Changes in Equity - partial section - Retained Earnings

For the year ended August 31,20X9

Required:

Calculate the balance in the Investment in Cold account as at August 31,20X9,if the company accounted for this subsidiary using the equity basis.

Calculate the balance in the Investment in Cold account as at August 31,20X9,if the company accounted for Cold as an associate using the proprietary theory basis for the equity method.

Explain the difference between the two balances.

Goodwill is determined using the parent-company extension approach.

Definitions:

Situational Low Self-Esteem

A temporary decrease in confidence and self-worth triggered by specific situations or events.

Major Depressive Disorder

A clinical condition where an individual suffers from severe depression symptoms that interfere with daily life and functionality.

Powerlessness

The feeling of lacking control or influence over one's own life or external circumstances.

Q5: On December 1,20X5,Gillard Ltd.sold goods to International

Q19: Which of the following is not an

Q26: Which of the following is NOT an

Q28: On September 1,20X5,Hot Limited decided to buy

Q28: What is securitization?<br>A)It is the process of

Q31: Bud Ltd.owns 100% of Calla Co.Calla owns

Q64: A restaurant has been sued because a

Q79: FICA tax is paid by both the

Q161: After the second interest payment on

Q224: element of the marketing mix that describes