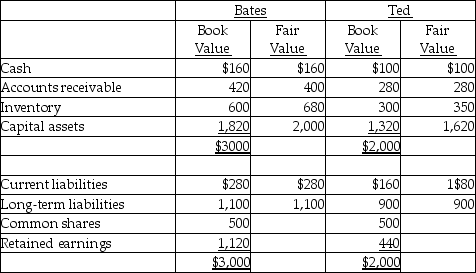

On December 31,20X2,Bates Ltd.purchased 75% of the outstanding common shares of Ted Ltd.for $1,050,000 in cash.The balance sheets of Bates and Ted immediately before the acquisition were as follows (in 000s) :

At the time of acquisition,Ted's capital assets still had a remaining useful life

Of ten years.What is the amount of the adjustment to the net book value of capital assets on the consolidated statement of financial position at December 31,20X2 under the parent-company approach?

Definitions:

Allowance

In accounting, a reduction from the gross amount of receivables to reflect the estimated uncollectible amounts; in budgeting, an allocated amount for specific expenses.

Doubtful Accounts

Accounts receivable that a company does not expect to collect in full, often leading to an allowance for doubtful accounts as a contra asset on the balance sheet.

Allowance Method

An accounting technique used to manage accounts receivable and bad debt expense by estimating uncollectible accounts at the end of each period.

Net Income

The total revenue of a business minus total expenses, representing the profit made during a specific period.

Q7: Describe the four fundamental ways in which

Q23: four utilities marketing creates are<br>A) product, price,

Q25: What type of not-for-profit (NFP)organization may be

Q104: McDonald Sales prepared a bond issue of

Q116: college students have a choice in which

Q118: On November 1,2013,Archangel Services issued $200,000

Q123: At the end of the year,what

Q141: Assume you are a salesperson for a

Q214: avoid new-product failure,new-product expert Robert M.McMath suggests<br>A)

Q256: cluster of benefits that an organization promises