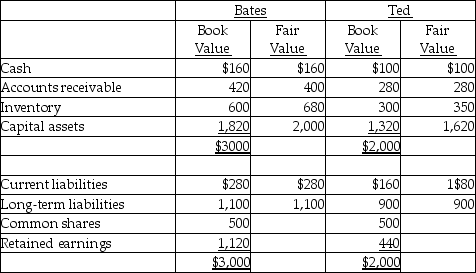

On December 31,20X2,Bates Ltd.purchased 75% of the outstanding common shares of Ted Ltd.for $1,050,000 in cash.The balance sheets of Bates and Ted immediately before the acquisition were as follows (in 000s) :

At the time of acquisition,Ted's capital assets still had a remaining useful life

Of ten years.What is the amount of the adjustment to the net book value of capital assets on the consolidated statement of financial position at December 31,20X2 under the parent-company approach?

Definitions:

Q3: Which of the following statements is true

Q4: A parent company owns a subsidiary's preferred

Q6: On December 31,20X5,Paper Co.purchased 60% of the

Q14: The transportation fleet department for a provincial

Q16: Showstoppers refer to<br>A) creative or innovative members

Q24: Which financial reporting objective is common to

Q31: On December 31,20X5,Space Co.purchased 100% of the

Q37: Fair value increments on depreciable assets _.<br>A)should

Q75: ABC signed a 5-year,9% note payable for

Q104: McDonald Sales prepared a bond issue of