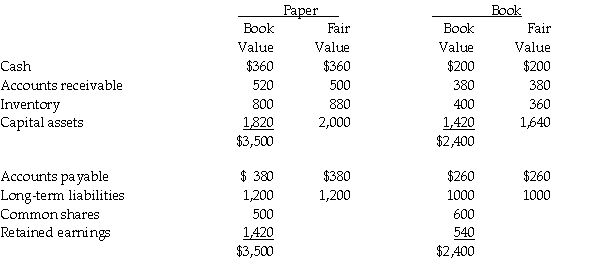

On December 31,20X5,Paper Co.purchased 60% of the outstanding common shares of Book Ltd.for $760,000 in shares and $200,000 in cash.The statements of financial position of Paper and Book immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-block" rel="preload" >