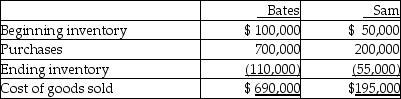

Bates Ltd.owns 60% of the outstanding common shares of Sam Ltd.During 20X6,sales from Sam to Bates were $200,000.Merchandise was priced to provide Sam with a gross margin of 20%.Bates' inventories contained $40,000 at December 31,20X5 and $15,000 at December 31,20X6 of merchandise purchased from Sam.Cost of goods sold for Bates and Sam for 20X6 on their separate-entity income statements were as follows:

What is the balance of the inventory account on Bates' consolidated statement of financial position at December 31,20X6?

Definitions:

Simulation Game

A video game or computer game that replicates real-life activities, systems, or environments for training, research, or entertainment purposes.

Competitive Choice

The concept involves selecting alternatives based on a competitive framework where the best option is chosen through comparison and evaluation against others.

Mixed-motive

Refers to situations or games in which participants have both shared and conflicting interests with each other.

Free Riding

The behavior of individuals who benefit from resources, goods, or services without contributing to the cost or effort involved in providing them.

Q1: inventor designs a scissors that has interchangeable

Q15: What effect does income smoothing have on

Q17: Under IFRS,which of the following statements about

Q21: Which of the following would be a

Q33: Gross pay is the total amount of

Q66: On January 1,2013,Davie Services issued $20,000

Q75: The current portion of mortgages payable would

Q91: your own personal experience and creativity to

Q118: On November 1,2013,Archangel Services issued $200,000

Q141: Assume you are a salesperson for a