On December 31,20X2,the Esther Company purchased 80% of the outstanding common shares of the Jane Company for $7.5 million in cash.On that date,the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

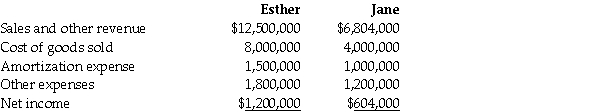

For the year ending December 31,20X4,the statements of comprehensive income for Esther and Jane were as follows:

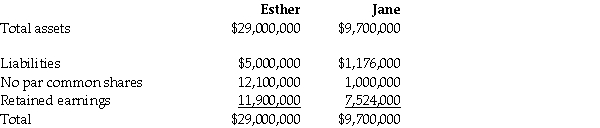

At December 31,20X4,the condensed statements of financial position for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate the non-controlling interest on the consolidated statement of financial position as at December 31,20X4 under the entity method.

Definitions:

Purposeful Behavior

Behavior that is directed towards achieving a specific goal or outcome.

Functional Assessment

A systematic process used to identify the underlying functions or purposes of a person's behavior in different environments.

Standardized Tests

Exams that are administered and scored in a consistent manner, often used in education to assess a student's achievement or abilities compared to a broader population.

Development Approach

A strategic process aimed at promoting growth, progress, or positive change within an individual, organization, or community.

Q1: Blanding Company issues $1,000,000 of 8%,10-year bonds

Q3: O'Ball Ltd.wants to acquire Kiro Ltd.to take

Q5: Ngo Ltd.'s subsidiary has restricted shares.What must

Q12: Which of the following is an indication

Q15: Tooker Co.acquired 80% of the outstanding common

Q15: ISP has a wholly owned subsidiary in

Q36: On December 31,20X5,CI Co.purchased 100% of the

Q107: A certain contingent liability was evaluated at

Q134: On January 1,2013,Diab Services issued $140,000 of

Q251: Social responsibility is<br>A) the view that organizations