On December 31,20X2,the Esther Company purchased 80% of the outstanding common shares of the Jane Company for $7.5 million in cash.On that date,the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

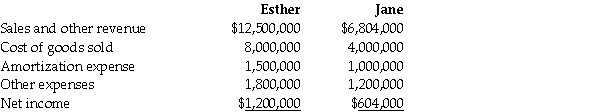

For the year ending December 31,20X4,the statements of comprehensive income for Esther and Jane were as follows:

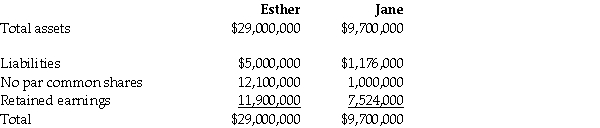

At December 31,20X4,the condensed statements of financial position for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate the retained earnings balance on the consolidated statement of financial position as at December 31,20X4 under the entity method.

Definitions:

Competitive Market

A market structure characterized by a large number of buyers and sellers, free entry and exit, and products that are similar enough to be interchangeable.

Long Run

A period of time in economics during which all inputs and conditions can be varied, allowing for full adjustment to changes.

Perfectly Competitive Market

A theoretical market structure characterized by an infinite number of buyers and sellers, where no single entity has the power to influence the market price.

Market Characteristics

Features that define a specific market, including the number of buyers and sellers, product differentiation, and level of competition.

Q2: Basaraba Ltd.owns 75% of the outstanding common

Q3: During the year,a not-for-profit art gallery acquired

Q8: In preparing consolidation working papers,why is it

Q15: Inventory was acquired as part of a

Q29: Ace Appliances sells dishwashers with a 3-year

Q35: For the 20X6 fiscal year,KU Care,a not-for-profit

Q55: Premium on bonds payable is considered to

Q81: Which of the following deductions must be

Q142: Dan Jones and Pat Smith are the

Q209: Which of the following statements describes an