On December 31,20X2,the Pipe Ltd.purchased 100% of the outstanding common shares of the Fitter Ltd.for $10.5 million in cash.On that date,the shareholders' equity of Fitter totaled $8 million and consisted of $1 million in no par common shares and $7 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

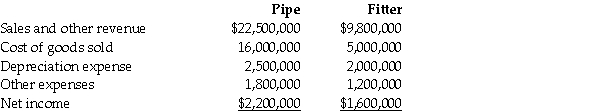

For the year ending December 31,20X6,the income statements for Pipe and Fitter were as follows:

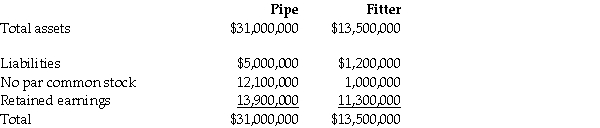

As at December 31,20X6,the condensed balance sheets for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Fitter had a building with a fair value that was $500,000 greater than its carrying value.The building had an estimated remaining useful life of 20 years.

2.On December 31,20X2,Fitter had trademark that was not reported on its balance sheet,but had a fair value that was $200,000.The trademark is amortized over 10 years.

3.During 20X6,Fitter sold merchandise to Pipe for $100,000,a price that includes a gross profit of $40,000.During 20X6,20% of this merchandise was resold by Pipe and the other 80% remains in its December 31,20X6 inventories.On December 31,20X5,the inventories of Pipe contained merchandise purchased from Fitter on which Fitter had recognized a gross profit in the amount of $50,000.

4.During 20X6,it was determined that the goodwill arising at the date of acquisition was impaired and that an impairment loss of $70,000 should be recorded.No impairment had been charged in earlier years.

5.During 20X6,Pipe declared and paid dividends of $300,000 while Fitter declared and paid dividends of $100,000.

6.Pipe accounts for its investment in Fitter using the cost method.

The retained earnings of Pipe as at December 31,20X5 equalled $12,000,000.On that date,Fitter had retained earnings of $9,800,000.Fitter has not issued any common stock since its acquisition by Pipe.

Required:

Prepare,in good form,a consolidated statement of comprehensive income for the year ended December 31,20X6.

Definitions:

Heterogeneity

Heterogeneity refers to the quality or state of being diverse in character or content, often used in various contexts to describe differences among individuals, populations, or data sets.

Technological Solution

An answer or fix to a problem that is achieved through technological tools, systems, or innovations.

Inseparable

In a service context, referring to the simultaneous production and consumption of services, indicating that services cannot be separated from their providers.

Perishable

Items, especially foodstuffs, that spoil or decay in a relatively short period and require special handling, storage, and quick consumption.

Q1: What is often the main motivation behind

Q3: For private enterprises that have acquired goodwill

Q8: Many countries around the world have adopted

Q11: On November 1,2013,Archangel Services issued $200,000

Q14: On March 1,20X2,McBride Ltd.issued a purchase order

Q31: A not-for-profit organization is not required to

Q33: On January 1,20X1,Belle Ltd.purchased 100% of the

Q146: Art Parrish,the sole employee of Parrish Sales,has

Q151: Tom's gross pay for this month is

Q262: Publix Supermarkets and The Little Clinic signed