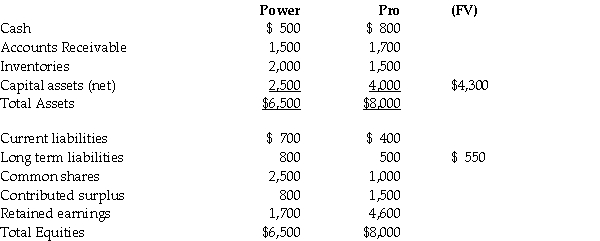

On December 31,20X6,the statements of financial position of the Power Company and the Pro Company are as follows: (in 000s)

Power Company has 100,000 shares of common stock outstanding.Pro Company has 45,000 shares outstanding.On January 1,20X7 Power issued an additional 90,000 shares of common stock in exchange for all the outstanding shares of Pro.All assets and liabilities have book value equal to fair values,except as noted.In addition,Pro has a patent that has an appraised fair value of $450.

Market value of the new shares issued was $95 per share at the date of acquisition.

Required: What is the amount of goodwill to be recorded for this business combination? Prepare the journal entry that Power would record on January 1,20X7 related to this acquisition.Prepare the consolidated statement of financial position as at January 1,20X7.

Definitions:

Retirement Savings Plan

A financial arrangement designed to help individuals save for their retirement, offering various tax advantages.

Contributions

Payments or deposits made into a particular fund or account for the purposes of investment or savings growth.

Compounded Monthly

A method of calculating interest where the interest earned each month is added to the principal, and future interest calculations are based on the new total.

Borrow

To borrow means to take something from someone for a limited time, intending to return it, often referring to money in financial contexts.

Q10: Which of the following is not a

Q14: Ensuring efficiency of the payroll process is

Q17: FICA tax is a tax which is

Q30: American business period that strives to satisfy

Q41: On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75%

Q90: Art Parrish,the sole employee of Parrish Sales,has

Q146: Art Parrish,the sole employee of Parrish Sales,has

Q150: Which of the following describes the first

Q158: On June 20,2013,Parker Services received $2,400 in

Q262: Publix Supermarkets and The Little Clinic signed