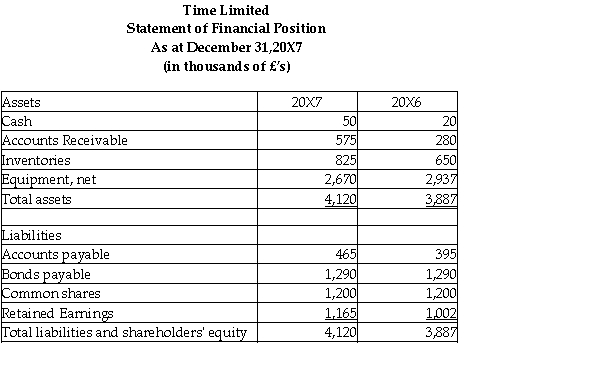

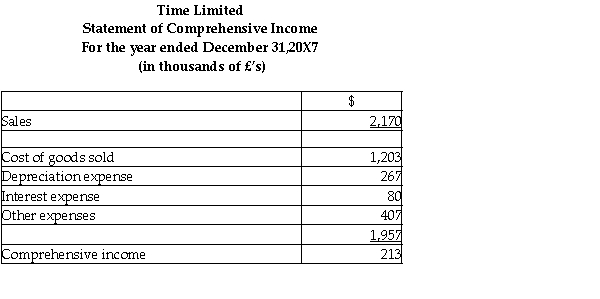

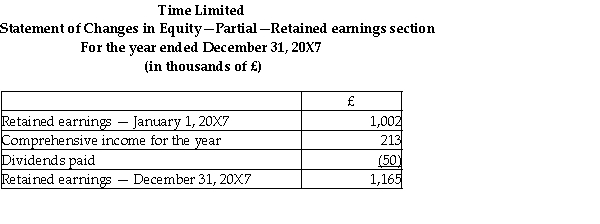

On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75% of the outstanding shares of Time Limited,in London England.Time Limited's statements of financial position,statements of comprehensive income and changes in equity - retained earnings section for the year ended December 31,20X7 are below.

Additional information:

1.Time was incorporated on January 1,20X3 when it acquired all its equipment for £4,005,000 and issued its 10 year bonds payable.

2.Time's purchases and sales occurred evenly over the year.Inventories on hand at December 31,20X6 and December 20X7 were purchased evenly over the last quarter of 20X6 and 20X7,respectively.Inventories as at December 31,20X7 were £650,000.

3.Dividends were paid on March 31,20X7.

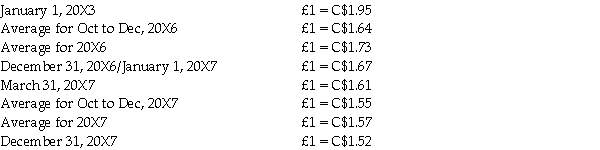

4.Foreign exchanges rates are as follows:

Required:

Translate Time's statement of comprehensive income for the year ended December 31,20X7 into Canadian dollars assuming its functional currency is Canadian dollars.Calculate the translation gain or loss arising in 20X7.

Definitions:

World Health Organization

A specialized agency of the United Nations responsible for international public health.

Bipolar Disorder

A mental disorder marked by extreme mood swings including manic (high) and depressive (low) episodes.

Neurotransmitter Imbalances

Neurotransmitter imbalances involve irregular levels of chemical messengers in the brain, which can affect mood, behavior, and cognitive functions.

Anxiety Disorders

A group of mental health conditions characterized by excessive fear, anxiety, and related behavioral disturbances.

Q1: Compare and contrast accounting for foreign currency

Q13: On March 1,20X2,McBride Ltd.issued a purchase order

Q21: Which of the following would be a

Q25: Dixon Ltd.owns 60% of the common shares

Q54: marketing manager's controllable factors-product,price,promotion,and place-that can be

Q85: market orientation refers to<br>A) the orientation of

Q107: Consider Figure 2-5 above.A small family owns

Q122: On December 31,2013,Peterson Sales has a Bonds

Q195: Which of the following statements best distinguishes

Q220: view that holds an organization should satisfy