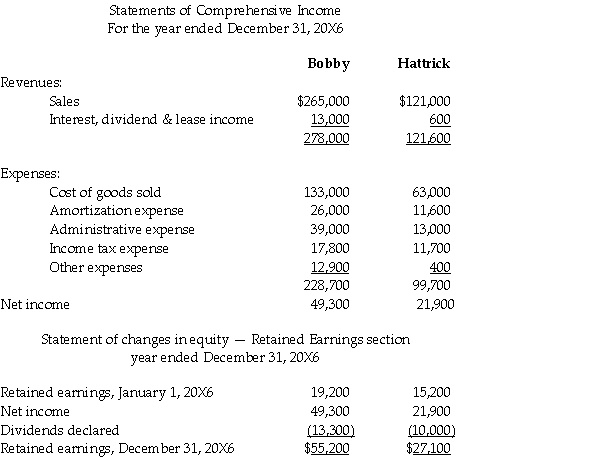

Hattrick Corp.is a wholly owned,parent-founded subsidiary of Bobby Inc.Both Bobby and Hattrick report under IFRS.The unconsolidated statements of comprehensive income and part of the statement of changes in equity-retained earnings for the two companies for the year ended December 31,20X6,are as follows (in 000s):

Additional information:

• Bobby sells some of its output to Hattrick.During 20X6,intercompany sales amounted to $25,000,000.Hattrick has accounts payable owing to Bobby for $200,000 at December 31,20X6.

• Bobby owns the land on which Hattrick's building is located.Bobby leases the land to Hattrick for $30,000 per month.

• Bobby accounts for its investment in Hattrick under the cost method.

Required:

Prepare a consolidated statement of comprehensive income and consolidated statement of changes in equity - retained earnings section for Bobby Inc.for the year ended December 31,20X6.

Definitions:

Bonus

An additional payment or reward given to an employee, often as recognition for good work or achievement.

Leadership Context

The situational environment or circumstances in which leadership is exercised, including organizational, social, cultural, and economic factors that influence leadership practices.

Individual Influences

The unique personal factors, such as personality, values, and experiences, that affect an individual's behavior and decisions.

Accomplish Goals

The process of setting specific, measurable objectives and working towards achieving them through planned actions and strategies.

Q2: Mallard Ltd.acquired 75% of the outstanding common

Q3: Utility refers to<br>A) the number of alternative

Q17: Recent surveys have suggested that there are

Q35: When a note is payable in installments,the

Q36: On June 1,20X4,Chua (Canada)Co.entered into a 90-day

Q42: A local ice cream shop pledged 10%

Q112: Tom's gross pay for the week is

Q143: idea that individuals and organizations are accountable

Q146: is the difference between micromarketing and macromarketing?

Q159: The journal entry for accrued interest on