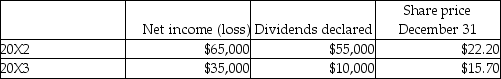

On January 1,20X2,Soho Co.purchased 4,000 shares,representing 12%,of Rico Inc.for $78,000.Soho is a publicly traded company.During the next two years,the following information was available for Rico.

Required:

a.Assuming Soho classifies this investment as FVTPL,prepare the journal entries for the next two years related to this investment,and the carrying value of the investment at the end of 20X2 and 20X3.

b.Assuming Soho classifies this investment as FVTOCI,prepare the journal entries for the next two years related to this investment,and the carrying value of the investment at the end of 20X2 and 20X3.

Definitions:

Church and State

The concept or legal principle concerning the separation of religious institutions and government entities, aiming to prevent any single religion from dominating public policy or government functions.

Indian Lands

Areas of land within the United States that are reserved for Native American tribes and are recognized as such by the federal government.

Massachusetts Bay Colonists

The settlers of the Massachusetts Bay Colony, an English settlement on the east coast of North America in the 17th century.

New England Indians

Indigenous peoples living in the region known as New England, in the northeastern United States, prior to and during European colonization.

Q4: In 20X5,Bing created a wholly owned subsidiary

Q5: An organization has identified the following segments:<br><img

Q5: For gains on intercompany bond holdings,which method

Q9: For not-for-profit organizations,the CICA Handbook _.<br>A)permits disbursement

Q9: For publicly-accountable companies,with foreign operations in countries

Q21: The CICA Handbook requires large not-for-profit organizations

Q36: Franklin Ltd. ,a subsidiary of Frayer Ltd.

Q36: How do joint ventures differ from private

Q88: FICA tax is paid by the employer

Q119: The current portion of notes payable is