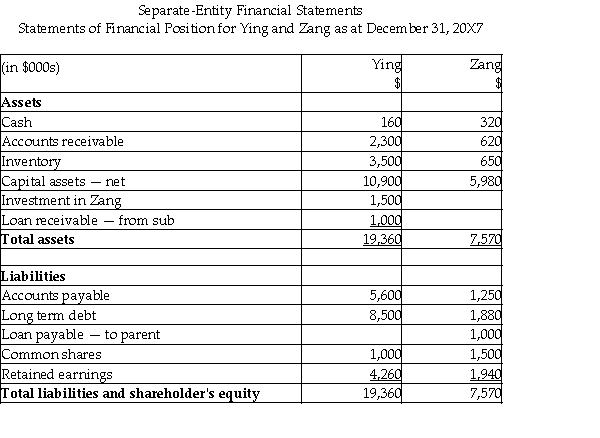

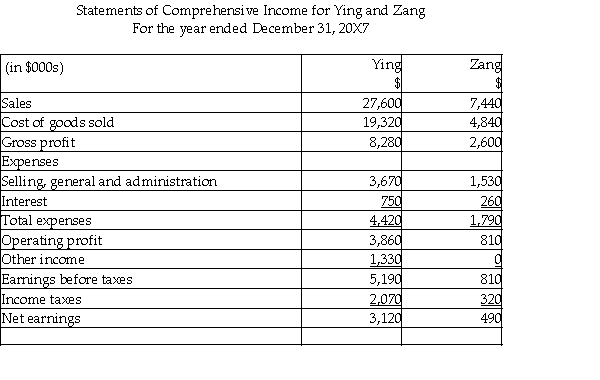

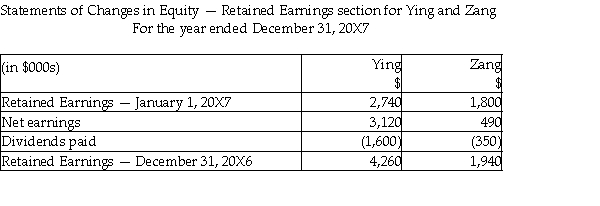

Ying Corporation formed a new subsidiary,Zang Limited,in 20X2.Ying is mainly involved in the manufacturing,distributing and retailing of dog food and Zang manufacturers and distributes cat food.At that time,Ying provided all of the start up capital to Zang in the form of equity,purchasing all of Zang's shares for $1.5 million.The unconsolidated statements for the two companies as at December 31,20X7 are shown below:

During 20X7,the following transactions took place (all dollars are in thousands):

• Ying provided a loan to Zang and charged interest totalling $80.

• Zang sold merchandise to Ying totalling $3,270,which was all subsequently sold to outside third parties by the end of the year.

• Included in Zang's receivables is $270 still owed by Ying for these sales.

• Ying charged management fees of $900 during the year to Zang.

Required:

Using the direct approach,prepare the consolidated statements of comprehensive income;statement of changes in equity-retained earnings section;and statement of financial position as at December 31,20X7.Show details of all of your work to arrive at the consolidated balances.Provide the consolidating journal entries required.

Definitions:

Evaluation And Management

The process of assessing a patient's health condition and determining the appropriate plan of care or treatment strategy.

Provider Services

Services offered by healthcare professionals or institutions to patients, including medical care, consultation, and treatment.

ICD-9-CM Manual

The International Classification of Diseases, Ninth Revision, Clinical Modification; a coding system used in the United States for diagnosis and hospital billing prior to ICD-10-CM.

Physician Offices

Medical facilities where doctors provide diagnostic, treatment, and preventive healthcare services to patients.

Q1: A contingent liability that will probably become

Q2: Which of the following is not a

Q6: Which of the following statements on professional

Q12: Sydney won a lottery and made a

Q22: Which consolidation method includes only the parent's

Q22: Chandler Ltd.owns 65% of Stork Co.and accounts

Q34: One of the objectives of government reporting

Q41: On March 1,20X2,McBride Ltd.issued a purchase order

Q125: Tangible assets must be tested for impairment

Q137: What amount should be recorded as the