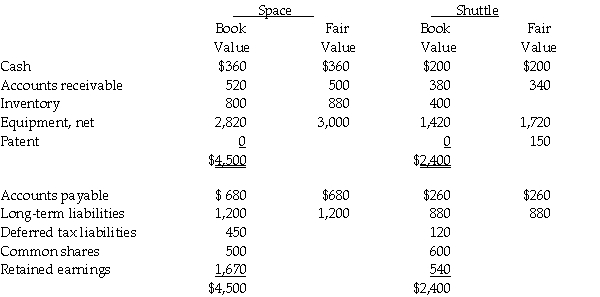

On December 31,20X5,Space Co.purchased 100% of the outstanding common shares of Shuttle Ltd.for $1,300,000 in shares and $200,000 in cash.The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The tax value for each asset and liability is the same as its carrying value except for the equipment which have a tax value of $950,000 and the patent which has a tax value of nil.The equipment has a remaining useful life of 15 years from the date of acquisition.The patent has a useful life estimated to be 5 years from the date of acquisition.

During 20X6,the year following the acquisition,the following occurred:

1.Shuttle borrowed $350,000 from Space on June 1,20X6,and was charged interest at 10% per annum,which it paid on a monthly basis.There were no repayments of principal made during the remaining of the year.

2.Throughout the year,Shuttle purchased merchandise of $800,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $250,000 on this merchandise.75% of this merchandise was resold by Shuttle prior to December 31,20X6.

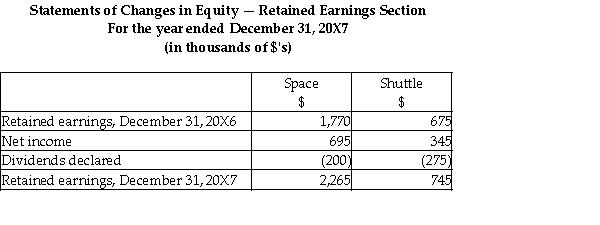

3.Shuttle paid dividends of $275,000 at the end of 20X6 and Space paid dividends of $200,000.

4.Shuttle and Space both have in income tax rate of 30%.

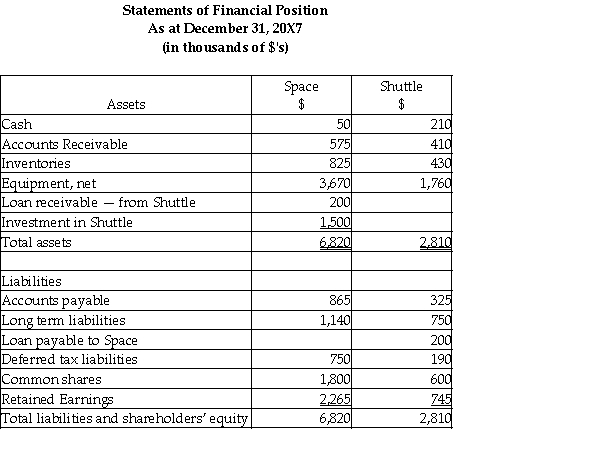

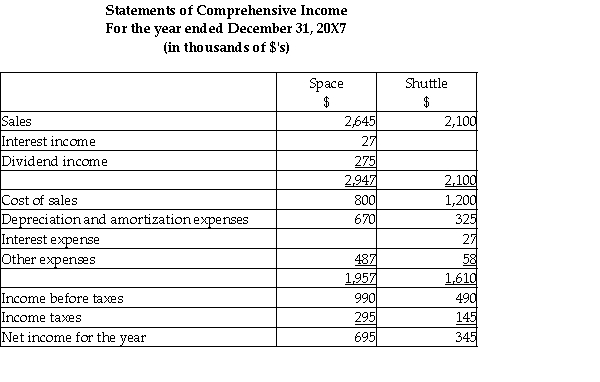

During 20X7,the following occurred:

1.Shuttle paid $150,000 on the loan payable to Space on May 30,20X7.

2.Throughout the year,Shuttle purchased merchandise of $1,000,000 from Space.Space's gross margin is 30% of selling price.At December 31,20X6,Shuttle still owed Space $150,000 on this merchandise.85% of this merchandise was resold by Shuttle prior to December 31,20X7.

3.Shuttle paid dividends of $275,000 at the end of 20X7 and Space paid dividends of $200,000.

4.Shuttle and Space both have an income tax rate of 30%.

Required:

Calculate the consolidated retained earnings as at December 31,20X7 and as at December 31,20X6.

Prepare the consolidated statement of comprehensive income and the consolidated statement of financial position for the year ended December 31,20X7 for Space.Include all relevant income tax calculations.

Definitions:

Aversive Stimulus

A stimulus that is unpleasant or painful, which an organism seeks to avoid or escape.

Positive Reinforcement

A technique used in behavioral psychology to increase the likelihood of a desired behavior by following it with the addition of a reinforcing stimulus.

Punishment

A consequence that decreases the likelihood of a behavior being repeated, often used as a form of behavioral control.

Half-hearted Attempts

Efforts or actions carried out with minimal enthusiasm or commitment.

Q4: Foster Ltd.acquired 100% of Benson Ltd.The carrying

Q12: Dupuis Ltd.acquired Waul Ltd.through a business combination

Q27: Sharon Peters is a controller is a

Q28: IFRS 8 requires the disclosure of certain

Q35: Blue Sky Inc.(BSI)is a public company which

Q43: On March 1,20X2,McBride Ltd.issued a purchase order

Q73: The current portion of notes payable would

Q94: Goodwill is NOT amortized-but evaluated-each year for

Q108: The Statewide Sales Company has gross

Q150: Which of the following describes the first