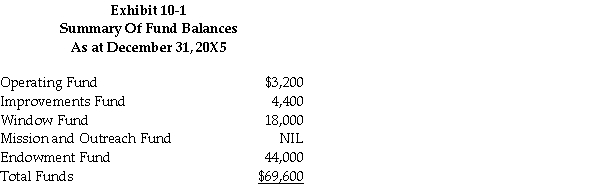

The Parish Council of Holy Trinity Church has decided to seek the advice of an accountant in preparing their financial statements.The records are in a disorganized state,however,certain information has been assembled.Exhibit 10-1 is a summary of the fund balances at December 31,20X5 and Exhibit 10-2 provides a summarized listing of the transactions for the year 20X6.

Required:

a.In general journal form,prepare summary journal entries to record the information in Exhibit 10-2.Keep the funds separate,by classifying them as follows:

b.Prepare a consolidated statement of financial for the funds of Holy Trinity Church as at December 31,20X6.

Description of Funds:

The operating fund is used to record all regular church receipts and operating expenses.The improvements fund is to record all major acquisitions of property,plant and equipment and is financed by allocations from the operating fund or by special donations.The window fund is a temporary fund established to enhance the church with stained glass windows (this fund is financed by special fund-raising events and by special donations).

The mission and outreach fund provides funds to overseas and local outreach projects.It is financed by contributions from the church members which have been specifically designated to this fund.The interest from the endowment fund is paid directly to the operating fund,but the principal cannot be spent.The fund is substantially financed by donations from estates.The entire sum of $44,000 has been invested in term deposits.

All funds are operated out of the same bank account,on the cash basis of accounting.

Exhibit 10-2

SUMMARY LISTING OF 20X6 TRANSACTIONS

1.Received regular weekly collections of $104,000.

2.Other donations during the year included: -

$27,000 for the mission and outreach fund

$6,500 for the window fund

$2,000 for the improvements fund

$10,000 for the endowment fund,invested in term deposits.

3.The $12,000 budgeted for the improvements fund was allocated from the operating fund.

4.Salaries of $66,500 were paid.

5.Operating expenses of $29,000 were paid,of which 43,000 were owing at December 31,20X5.At December 31,20X6 $4,200 of payables remained unpaid.

6.A special fund-raising dinner was undertaken to raise money for the window fund.Dinner tickets were sold for $3,200 and expenses of $450 for food and $150 for entertainment were paid.

7.Two stained glass windows were installed during the year at a cost of $21,000 of which $19,000 had been paid.Further,a window costing $8,500 had been ordered for 20X7.

8.An amount of $24,000 had been paid out of the mission and outreach fund for an African relief fund and $3,000 had been paid to a local food bank.

9.The improvements fund was used to pay for a $17,500 roof repair,and $4,800 for a new piano.

10.Interest in the amount of $4,100 was received by the operating fund from the endowment.

Definitions:

Groundwater

Water that occupies the pores and fractures in rock and soil beneath the Earth's surface, an important source of fresh water.

Lake

A large body of water surrounded by land, often formed by tectonic, volcanic, or glacial activity.

Groundwater

The water found under the surface of the Earth, occupying spaces in soil and cracks in geological formations.

Cross Section

A plane or surface cut through an object or structure, typically used to reveal its internal composition or structure.

Q4: On December 31,20X5,Space Co.purchased 100% of the

Q5: On March 17,20X2,Cho Co.acquired 100% of the

Q6: Which of the following costs related to

Q6: Cho Co. ,a public Canadian corporation has

Q9: For not-for-profit organizations,the CICA Handbook _.<br>A)permits disbursement

Q11: At the beginning of 20X1,Rally Ltd.acquired 18%

Q16: Which of the following correctly describes Interest

Q37: Art Parrish,the sole employee of Parrish

Q63: On January 2,2014,Mahoney Sales issued $10,000 in

Q131: On October 1,2012,Archer Sales borrows $100,000