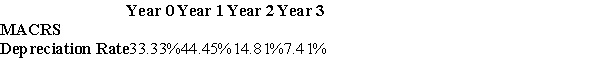

A firm is considering the purchase of a new machine for $300,000.The firm is unsure if it should use the 3-Year MACRS schedule or straightline depcreciation over three years.What is the difference in the book value after three years if the firm uses MACRS instead of straightline depreciation?

Definitions:

Compensation Expense

The total cost incurred by a company to compensate its employees, including wages, benefits, bonuses, and stock options.

Sales Increase

An upward trend in the volume or value of products or services sold by a business within a specific period, indicating potential growth or market acceptance.

Performance-Based Stock Option Plan

A compensation scheme where employees are granted options to purchase company stock based on meeting specific performance criteria, aligning their interests with shareholders.

Annual Average Increase

The yearly mean growth rate of an economic or financial metric, often calculated to understand the trend over a period.

Q44: What care,if any,should be taken when selecting

Q44: What can you comment about the shape

Q57: The price of Microsoft is $30 per

Q58: Which of the following best describes a

Q61: The depreciation tax shield for Shepard Industries

Q69: What are project externalities?

Q71: When comparing two projects with different lives,why

Q79: If returns on stock A are more

Q81: What is a safe method to use

Q82: A consumer good company is developing a