Use the table for the question(s) below.

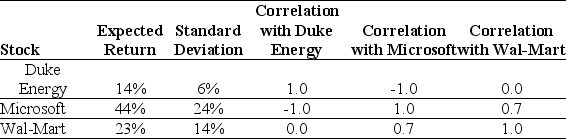

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

Definitions:

Cultural Factors

The social, economic, and political elements that influence and shape the beliefs and practices of a community or society.

Social-structural Factors

Elements of the social structure, such as institutions, hierarchies, and norms that influence or determine individual behaviors and societal patterns.

Québécois

People native to or living in Quebec, Canada, especially those of French Canadian descent and francophone culture.

Racial Relations

The interactions and social dynamics between people of different racial backgrounds.

Q6: Historical evidence on the returns of large

Q16: What is the major reason that underwriters

Q38: A firm requires an investment of $30,000

Q40: Jenkins Security has learned that a rival

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" A bakery invests

Q54: Assume JUP has debt with a book

Q55: Which of the following best describes the

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" Bejeweled,a chain of

Q67: What kind of corporate debt has a

Q89: What is yield to worst?