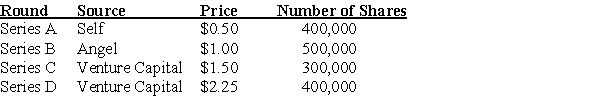

David found a company and goes through the investment rounds shown below:

He decides to take the company public through an IPO,issuing 2 million new shares.Assuming that he successfully completes the IPO,the net income for the next year is estimated to be $8 million.His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses,which is 15.0.What will be the IPO price per share?

Definitions:

Market Price

Today's price for buying or selling a service or asset within the marketplace.

Equity Multiplier

is a financial ratio indicating the proportion of the company’s assets financed by stockholders' equity, showing leverage.

Balance Sheet

A balance sheet that portrays a company's financial standing in terms of assets, liabilities, and the equity of its shareholders at a particular point.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, ending with the net income or loss for the period.

Q3: If a stock pays dividends at the

Q11: The S&P 500 index delivered a return

Q17: Which of the following statements is FALSE?<br>A)The

Q27: Danroy Inc has announced a $5 dividend.If

Q35: Is total net working capital or incremental

Q49: With perfect capital markets,the total value of

Q59: Suppose that a stock gave a realized

Q80: Which of the following equations is INCORRECT?<br>A)Cov(R<sub>i</sub>,R<sub>j</sub>)=

Q81: The face value of bonds are denominated

Q91: Which of the following statements is TRUE?<br>A)On