Use the information for the question(s) below.

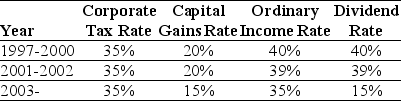

Consider the following tax rates:

*The current tax rates are set to expire in 2010 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2010 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

Definitions:

Fixed Costs

Costs that do not vary with the volume of production or sales, such as rent, salaries, and insurance.

Discounted Cash Flow (DCF)

A valuation method used to estimate the value of an investment based on its future cash flows, adjusted for the time value of money.

Capital Budgeting Techniques

Methods used to evaluate and prioritize investment projects or expenditures, such as NPV, IRR, Payback Period, and Profitability Index.

Small Businesses

Enterprises characterized by a small number of employees, limited revenue, and size within their industry.

Q9: Which of the following statements is FALSE?<br>A)In

Q14: Which of the following statements is FALSE?<br>A)The

Q15: Which of the following statements is FALSE?<br>A)Once

Q18: A company issues a callable (at par)five-year,7%

Q26: The above graph shows the levels of

Q30: Assume that Omicron uses the entire $50

Q71: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" The data above

Q77: A firm issues $200 million in ten-year

Q87: Which of the following firms would be

Q102: Evertz Metals buys and stockpiles dolomite to