Use the information for the question(s) below.

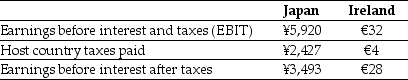

KT Enterprises,a U.S.import-export trading company,is considering its international tax situation.KT's U.S.tax rate is 21%.KT has significant operations in both Japan and Ireland.In Japan the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-The amount of the taxes paid in dollars for the Irish operations is closest to:

Definitions:

Stock Prices

The current market price at which a share of a company is bought or sold.

Price Changes

Adjustments in the price levels of goods, services, or securities in the market.

Market Efficiency

A financial market attribute where prices of securities fully reflect all available information at any moment in time.

Excess Return

The return achieved by an investment over and above the return of a benchmark index or risk-free rate, signifying performance attributable to the investment's risk.

Q6: A firm expects growth next year to

Q12: To protect the firm against the loss

Q27: The production manager of a company was

Q28: Suppose that a stock sells at a

Q71: What is floating rate?

Q94: The spot exchange rate for the British

Q100: Which of the following statements MOST accurately

Q110: Which of the following companies has the

Q134: When companies use the management by exception

Q146: Employee skills, information system capabilities, and the