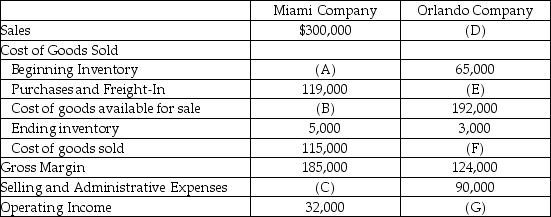

Compute the missing amounts.

Definitions:

Variable Costing

An accounting method that only considers variable costs (costs that vary with the level of output) when calculating the cost of goods sold and production.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a unit of product.

Net Operating Income

Represents the difference between operating revenues and operating expenses.

Common Fixed Expenses

Expenses that do not vary with the level of production or sales, shared among different business segments or products.

Q20: James Industries uses departmental overhead rates to

Q26: The key factor attracting both depositors and

Q40: Financial globalization has not resulted in:<br>A) continuing

Q62: Typically,a firm in its domestic stage of

Q138: Nadal Company is debating the use of

Q167: Decision making is guided only by differential

Q209: A _ is a source document used

Q210: To determine the amount of overhead allocated,the

Q233: In the United States,the fastest growing type

Q281: Chicago Steel's operating activities for the year