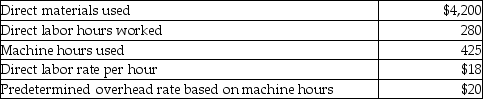

Cooper's Company manufactures custom engines for use in the lawn and garden equipment industry.The company allocates manufacturing overhead based on machine hours.Selected data for costs incurred for Job 798 are as follows:

What is the total manufacturing cost of Job 798?

Definitions:

Fiscal Year

A one-year period that companies and governments use for financial reporting and budgeting, which doesn't necessarily coincide with the calendar year.

Fiscal Year

A one-year period that companies and governments use for accounting purposes and preparation of financial statements, which may not align with the calendar year.

December 31

The last day of the year, often used as a cut-off date for annual financial reports and assessments.

Liabilities

Obligations of a monetary nature that an organization must fulfill to others, involving the exchange of economic values over an established timeframe.

Q20: The Candy Factory manufactures healthy candy that

Q21: The key to allocating indirect manufacturing costs

Q80: The use of which of the following

Q91: Which of the following cost of quality

Q169: The goal of total quality management (TQM)is

Q172: All of the following items would be

Q203: What is a business philosophy that focuses

Q203: The following information was gathered for the

Q267: You are trying to decide whether or

Q308: The overhead allocation base should be the