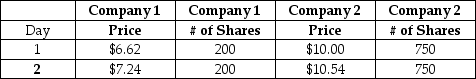

Consider a value-weighted market index that includes the two companies shown in the table.You form a portfolio to mimic the index on Day 1.The mimic portfolio is designed to earn the same return as the index.What is the portfolio weight for Company 1?

Definitions:

Bottom Line

The ultimate sum of an account, balance sheet, or financial outcome, frequently alluding to a corporation's net earnings or gain.

Anne Mulcahy

Former CEO of Xerox Corporation, known for leading the company through a successful turnaround.

Reactive

A response or behavior characterized by action taken after the fact, responding to events or situations rather than initiating or preventing them.

Nadler-Tushman Model

A framework for organizational diagnosis that emphasizes the importance of inputs, transformational processes, and outputs within organizations, and how misalignment among these elements can lead to issues.

Q3: The entire urea cycle occurs within the

Q6: The Table below presents returns across three

Q33: A popular value-weighted index is constructed out

Q47: If two stocks have a correlation of

Q57: What is the yield to maturity of

Q58: Bank of America bonds are currently trading

Q60: Each of the following is a ratio

Q65: Income Statement<br>Molson Coors Inc.<br>Years 1 & 2

Q72: Erythropoietin (EPO)has the effect of increasing the

Q79: An investment of $1,000 will return $60