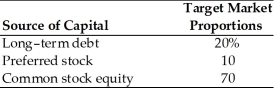

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-If the target market proportion is reduced to 15 percent, what will be the revised weighted average cost of capital? (See Table 9.1)

Definitions:

Peak Period

The time when demand for goods or services is at its highest, often leading to increased prices and competition.

Time Flexibility

The ability to adapt to changes in scheduling or deadlines.

Workforce

The collective group of individuals engaged in work within an organization, encompassing all employees and labor.

Part-Time Workforce

Employees who work less than full-time hours and often have variable schedules, contributing to labor flexibility and cost management.

Q3: The weighted average cost of capital (WACC)reflects

Q5: Ted Corporation expects to generate free-cash flows

Q26: Gillian's Boutique has 850,000 shares of common

Q31: The firm's after-tax cost of debt is

Q32: Climax Motors Corp.is an all equity company

Q43: A trustee is a paid party representing

Q57: An 8 percent preferred stock with a

Q64: If you expect the market to increase

Q75: The return on an asset is the

Q189: Since the issuer of zero (or low)coupon