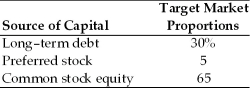

A firm has determined its optimal capital structure,which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year,$1,000 par value,9 percent bond for $980.A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value.The stock will pay an $8.00 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share.The dividend expected to be paid at the end of the coming year is $5.07.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.45.It is expected that to sell,a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

SSR

Sum of Squares for Regression, a statistical measurement that represents the variation explained by the independent variables in a regression model.

SSE

Sum of Squared Errors, a measure used in statistics to quantify the discrepancy between the observed and model-predicted values.

Sum Of Squares

In statistics, the sum of squares is a measure used to quantify the variation or dispersion of a set of numbers.

Independent Variables

Variables in an experiment or model that are manipulated or classified by the researcher to observe their effect on the dependent variable.

Q4: The firm's cost of retained earnings is

Q14: If a market is truly efficient,investors should

Q29: Select financial data for Ewing Oil Inc.is

Q30: B&O Railroad Inc.transports industrial products and supplies

Q36: Cash-2-Day currently trades for $13.Analysts regard it

Q52: What is the expected return for Asset

Q64: If a firm applies its overall cost

Q78: On average in U.S.,during the past 75

Q86: A call feature is a feature that

Q154: Tangshan China Company's stock is currently selling