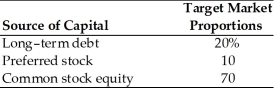

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of retained earnings is ________. (See Table 9.1)

Definitions:

Budget Balancing

The process of adjusting government spending and revenue to ensure that the budget is not in deficit, aiming for a balanced budget.

Federal Budget

An itemized plan for the annual public expenditures of the United States, detailing government spending and revenue.

Paradox Of Thrift

The economic theory that personal savings can be detrimental to overall economic growth if too high, as they may reduce overall demand.

Great Recession

A severe global economic recession that occurred from late 2007 through mid-2009, characterized by widespread financial crisis, high unemployment, and significant drops in the economic activity.

Q8: The _ is a financial relationship created

Q14: Utility Muffin Research Kitchen Inc.is financed with

Q49: The Boeing Corp.is considering building a new

Q56: The cash flows for two projects,A and

Q61: Preferred stock has characteristics of debt since

Q70: Droids-R-Us Inc.(DRU),is considering the installation of a

Q72: The range of an asset's risk is

Q87: Ben's Ice Cream just paid their annual

Q117: Which of the following typically applies to

Q149: Angel recently purchased a block of 100