Multiple Choice

Table 8.3

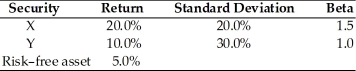

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

Definitions:

Related Questions

Q6: The cost of new common stock financing

Q46: In computing the weighted average cost of

Q47: The constant-growth valuation model is based on

Q56: The cash flows for two projects,A and

Q66: In U.S.,during the past 75 years,on an

Q83: Goodweek Tire,Inc.,has recently developed a new tire,the

Q95: Everything else being equal,the longer the period

Q107: Which of the following is true of

Q123: The purpose of the debt covenant that

Q137: _ are financial instruments that allow stockholders