Table 11.8

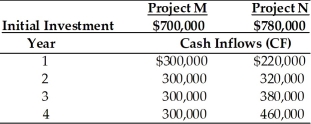

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the better investment for Tangshan Mining is ________.(See Table 11.8)

Definitions:

Credit Availability

The ease with which individuals and businesses can obtain loans and other forms of credit from financial institutions.

Liquid Assets

Assets that can be quickly converted into cash with little impact on their value.

Consumption Rate

The proportion of income or resources that is spent on consumption rather than saving.

Savings Rate

The proportion of disposable income that is saved rather than spent on consumption, typically expressed as a percentage.

Q6: The bird-in-the-hand argument espousing the importance of

Q53: Legal constraints prohibit the payment of cash

Q71: A mixer was purchased two years ago

Q93: A firm's dividend payout ratio is calculated

Q94: While an earnings requirement limiting the amount

Q112: Financing decisions deal with the left-hand side

Q146: If a firm has unlimited funds to

Q153: Which of the following is a difference

Q164: Consider the following projects,X and Y,where the

Q187: A corporation is evaluating the relevant cash