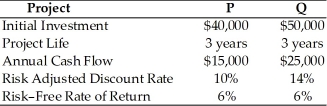

Table 11.9

Johnson Farm Implement is faced with two mutually exclusive projects,P and Q.The following are the data about the two projects.

-Evaluate the projects using risk-adjusted discount rates.(See Table 11.9)

Definitions:

Total Common Equity

The sum of a company's shareholders' equity, excluding preferred shares, represented by common stock, retained earnings, and other accumulated comprehensive income.

Cash Flow Per Share

A financial metric that represents the amount of cash generated by a company, per share, over a specific period.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life.

Ratio Analysis

A quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by comparing financial statement items.

Q1: Which of the following is considered in

Q19: The net present value of the project

Q63: Using the risk-adjusted discount rate method of

Q70: Futures and options are opportunities that are

Q106: The cash flow pattern depicted is associated

Q111: A nonconventional cash flow pattern associated with

Q138: Sunk costs are cash outlays that have

Q145: A firm has fixed operating costs of

Q152: A corporation is considering expanding operations to

Q164: Financial leverage measures the effect of fixed