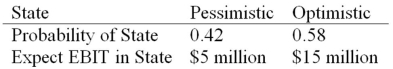

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Printer-And-Ink

A common business model in the printing industry where printers are sold at a low cost and the recurring revenue is generated through the sales of ink cartridges.

Ubiquitous

Present, appearing, or found everywhere; often used to describe technology or phenomena that are widespread and common in daily life.

Razor-And-Razor-Blade Revenue Model

A business strategy where a company sells a durable product at a low price to increase the sale of disposable complementary products.

Tangible

Something material or concrete that can be touched or physically measured, unlike abstract concepts or ideas.

Q1: A financial manager has determined that the

Q13: Exchange Rate Quote Convert the following indirect

Q28: You are evaluating two different machines.Machine A

Q32: Calculation of Altman's Z-Score: Use the following

Q35: Economies of Scope A survey of a

Q39: Which of these is defined as the

Q60: The level of EBIT at which EPS

Q67: Which of these is a capital budgeting

Q91: Painting,Inc.has sales of $400,000 and cost of

Q100: Economies of Scope A survey of a