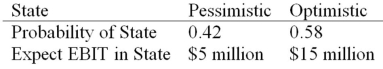

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Nonsilicate Mineral

Minerals that do not contain silicon-oxygen tetrahedra, including various groups like carbonates, sulfates, and oxides.

Plagioclase Feldspar

A group of common rock-forming silicate minerals that are significant components of many igneous rocks.

Potassium Feldspar

A very common silicate mineral that contains potassium; synonym: K-feldspar.

Meteorite

A solid piece of debris from an object, such as a comet, asteroid, or meteoroid, that originates in outer space and survives its passage through the Earth's atmosphere to reach the ground.

Q34: How can managers' personal incentives result in

Q37: Which of the following will increase the

Q51: A pro-rata distribution of additional shares of

Q81: The set of assumptions underlying the firm's

Q83: Suppose two projects with normal cash flows,X

Q91: If more dollars are required to buy

Q104: Suppose your firm is considering investing in

Q112: Which of these is defined as the

Q112: Which strategy-active or passive capital structure management-would

Q123: Suppose your firm is considering investing in