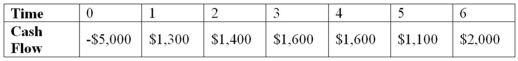

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half four and a half years,respectively.Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Corporate Debt

Financial obligations incurred by companies through borrowing, issuing bonds, or other financial instruments to support operations or growth.

Financial Leverage

The use of borrowed money (debt) to amplify the potential returns from an investment, increasing risk and potentially reward.

Financial Distress

A condition in which a company cannot generate the revenues or income necessary to meet its financial obligations, which may lead to bankruptcy.

MM Propositions

The Modigliani-Miller propositions, which are foundational theorems in corporate finance, asserting that under certain conditions, the value of a firm is unaffected by its capital structure.

Q6: Which of the following statements is correct?<br>A)The

Q12: Suppose a firm has had the historical

Q46: An average of which of the following

Q47: Suppose that Glamour Nails,Inc.'s capital structure features

Q61: Hollywood Shoes would like to maintain their

Q69: Suppose that Wind Em Corp.currently has the

Q75: Section 179 allows a business,with certain restrictions,to

Q89: A proxy beta is:<br>A)the average beta of

Q90: All capital budgeting techniques:<br>A)render the same investment

Q97: Suppose your firm is considering two independent