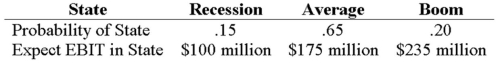

Your company has a 40 percent tax rate and has $750 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 30 percent debt capital structure,and has determined that they would have to pay a 9 percent yield on perpetual debt in either event.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Limbic System

A complex system of nerves and networks in the brain, involved in various emotional states and biological drives.

Cerebellum

A part of the brain located at the back of the skull in vertebrates, responsible for coordinating muscle movements and maintaining posture and balance.

Repolarization

The process of restoring the negative charge inside a nerve cell after depolarization, essential for the transmission of nerve impulses.

Sodium Gates

Protein channels in cell membranes that open or close to allow sodium ions to enter or exit, playing key roles in generating electrical signals.

Q25: ABC Corp.is expected to pay a dividend

Q45: Suppose that Papa Bell Inc.'s equity is

Q49: George's Dry Cleaning is considering a merger

Q50: If a firm has retained earnings of

Q60: Over the past decade,China has acquired hundreds

Q72: An all-equity financed firm has $450 in

Q73: Calculating Fees on a Loan Commitment You

Q75: When a stockholder's stake is worthless the

Q85: Sipe's Paint and Wallpaper,Inc.,needs to raise $1.19

Q88: Suppose a firm has had the historical