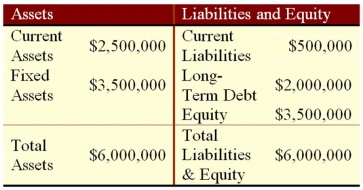

Suppose that Psy Ops Industries currently has the balance sheet shown as follows,and that sales for the year just ended were $6 million.The firm also has a profit margin of 9 percent,a retention ratio of 5 percent,and expects sales of $8.5 million next year.If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales,how much additional funds will Psy Ops need from external sources to fund the expected growth?

Definitions:

Notes Payable

Obligations in the form of written notes.

Accounts Payable

A liability account that records amounts the company owes to suppliers or creditors for goods and services purchased on credit.

Note Payable

A financial obligation or loan evidenced by a written promissory note, specifying terms of repayment.

Interest Payment

Interest Payment is the payment made to a lender by a borrower, representing the charge for the privilege of borrowing money.

Q17: Which of the following is NOT a

Q55: A U.S.firm is expecting cash flows of

Q64: Scribble,Inc.has sales of $80,000 and cost of

Q77: GBH Inc.is planning on announcing a 5-for-2

Q89: HiLo,Inc.,doesn't face any taxes and has $100

Q90: Most business loans today are:<br>A)pre-negotiated lines of

Q93: What effect does decreasing the standard deviation

Q96: Sky,Inc.normally pays a quarterly dividend.The last such

Q111: A situation that arises when a firm's

Q130: Cup Cake Ltd.has 20 million shares of