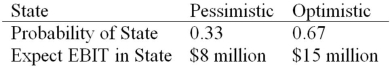

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the break-even level of EBIT?

Definitions:

Diversity

The inclusion of individuals with a wide range of characteristics and backgrounds, such as ethnicity, gender, age, sexual orientation, and more.

Physical Abilities

The capacity of an individual to perform physical tasks or activities.

Top Management

The highest level of organizational leadership responsible for the overall strategic direction and decision-making.

Nissan-Renault

A strategic alliance between the Japanese automotive manufacturer Nissan and the French company Renault, aimed at leveraging each other's strengths in the global market.

Q27: A firm has retained earnings of $11

Q27: Which of these is a contractual commitment

Q42: Suppose a firm has had the historical

Q43: Your company doesn't face any taxes and

Q57: Which of the following is an example

Q72: Suppose that Runner Industries currently has the

Q84: Suppose your firm is seeking a 7-year,amortizing

Q91: A facility fee is:<br>A)the back-end fee.<br>B)the commitment

Q103: Rose Resources faces a smooth annual demand

Q117: Suppose your firm is considering two mutually