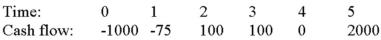

Compute the payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 9 percent and the maximum allowable payback is four years.

Definitions:

Public Goods

Goods that are non-excludable and non-rivalrous, meaning they can be consumed by one individual without preventing the consumption by others, and without leading to a decrease in available quantity.

Inefficient Allocation

When resources are not optimally distributed, leading to a situation where it is possible to improve at least one person's well-being without worsening any other's situation.

External Effects

Consequences of economic activities on unrelated third parties; can be positive (benefits) or negative (costs).

Knowledge Creation

The process through which new ideas, information, and understanding are generated, often leading to innovation and improvements in technology or methodology.

Q54: Suppose that Papa Bell Inc.'s equity is

Q55: Suppose your firm is considering investing in

Q56: You are trying to pick the least-expensive

Q62: Portfolio Beta You hold the positions in

Q63: Explain Gordon and Lintner's bird-in-the-hand theory.

Q68: Your company is considering the purchase of

Q86: Expected Return Risk Compute the standard deviation

Q92: If the U.S.government completely eliminated taxation at

Q111: Your firm needs a computerized machine tool

Q115: A local bank is contemplating adding a