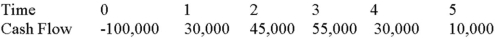

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Door-to-Door

A direct selling method where salespeople physically visit potential customers' homes or businesses to sell products or services.

Prospecting

The method of locating prospective clients or customers for a company's offerings or services.

A professional networking platform that allows users to connect with others in their industry, search for jobs, and share content.

Antique Fishing Gear

Historic or collectible items related to fishing, often valued for their age, craftsmanship, and rarity.

Q21: Which of the following is incorrect?<br>A)Technical analysis

Q24: You hold the positions in the following

Q34: Under what conditions can a rate-based statistic

Q57: Balloons,Inc.normally pays a quarterly dividend.The last such

Q75: Carrying costs are associated with having current

Q78: Consider an asset that provides the same

Q97: If an investor wanted to reduce the

Q99: The operating cycle will increase with all

Q101: A financial analyst calculated that the after-tax

Q111: A situation that arises when a firm's