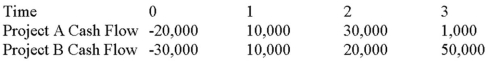

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Total Surplus

The sum of consumer surplus and producer surplus in a market, representing the total net benefit to society.

Equilibrium Price

The price at which the quantity of a good demanded by consumers equals the quantity supplied by producers, leading to market stability.

Equilibrium Quantity

The amount of goods or services that are bought and sold at the equilibrium price, where market demand meets market supply.

Consumer Surplus

The discrepancy between the total sum consumers are prepared and able to spend on a good or service and what they ultimately pay.

Q39: Which of these is defined as the

Q48: CJ Corp.is expected to pay a dividend

Q61: Your company is considering a new project

Q62: Explain how the firm apportions risk and

Q63: Which of the following statements is correct?<br>A)A

Q71: Suppose that Darlene's Donuts has annual sales

Q77: Rose Axels faces a smooth annual demand

Q87: Suppose that Tan Lines' common shares sell

Q90: JJJ Corp.has $10 million in assets and

Q125: Which of following is a situation in