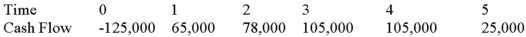

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

External Locus of Control

A psychological concept suggesting that individuals believe external forces or circumstances primarily determine their life events and outcomes.

Situational

Related to or dependent on a particular set of circumstances or context.

Dispositional

Relating to the inherent qualities, traits, or tendencies that contribute to a person's enduring behavior patterns or characteristics.

Psychodynamic Theory

A psychological perspective that emphasizes unconscious processes and past experiences as determinants of an individual's behavior and personality.

Q15: Compute the discounted payback statistic for Project

Q37: Explain what a PI of 35.23 percent

Q46: Suppose your firm is considering investing in

Q53: IBM's stock price is $22,it is expected

Q55: Which of the following statements is correct?<br>A)If

Q74: Town Crier has 10 million shares of

Q76: The study of the cognitive processes and

Q94: You obtain beta estimates of General Electric

Q94: What is the difference between a lockbox

Q119: Which of the following will decrease the