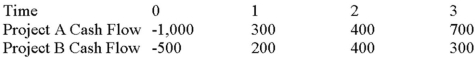

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Stress Reactions

The physical, emotional, and behavioral responses generated by perceived threats or challenges to an individual's wellbeing.

Immune Deficiencies

Conditions where the immune system's ability to fight infectious disease and cancer is compromised or entirely absent.

Stress Reaction

The body's response to any demand or threat, involving psychological and physical changes that prepare the individual to act to eliminate the stressor.

Accumulative Stress

Stress that builds up over time due to ongoing pressures and challenges, often leading to significant psychological or physical health issues.

Q19: You have been asked by the president

Q43: The operating cycle will decrease with all

Q49: A project has normal cash flows.Its IRR

Q55: Your company doesn't face any taxes and

Q59: Which of these is the line on

Q70: Compute the MIRR statistic for Project J

Q87: Which of the following current asset financing

Q94: Bill's Boards has 20 million shares of

Q94: Your firm needs a machine which costs

Q117: You are evaluating two different cookie-baking ovens.The