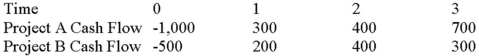

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Least-Squares Fit

A method of estimating the parameters of a model by minimizing the sum of the squares of the differences between the observed and predicted values.

Pass%

The percentage of individuals or units that meet or exceed a defined benchmark or standard.

Standard Error

A measure of the statistical accuracy of an estimate, often used to quantify the uncertainty in the mean of a population estimated from a sample.

Pearson's Correlations

A measure of the linear correlation between two variables, ranging from -1 to 1, where 1 means a perfect positive linear correlation, and -1 means a perfect negative linear correlation.

Q4: Which of the following will decrease the

Q24: Your company doesn't face any taxes and

Q28: What is required to use the constant-growth

Q38: Suppose that the 2013 actual and 2014

Q43: Company Risk Premium A company has a

Q59: Denote the impact that flotation costs have

Q103: Which of the following is a principle

Q123: Suppose your firm is considering investing in

Q130: If demand for a firm's products suddenly

Q137: If a firm has a cash cycle