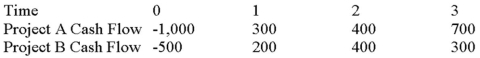

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

External Cost

A cost incurred by a third party who did not agree to the action that caused the cost, often associated with negative environmental impacts or health hazards.

Antibiotic-Resistant

Referring to bacteria that have evolved to survive exposure to antibiotics that were previously effective in killing them or inhibiting their growth.

Government Policy

Actions and decisions made by the government to achieve certain goals or address specific issues within a country.

Antibiotic Overuse

The excessive or inappropriate use of antibiotics, contributing to antibiotic resistance, where bacteria evolve to become resistant to these medications.

Q5: First order effects are defined as which

Q8: When calculating WACC,should project-specific or firmwide debt

Q42: KADS,Inc.,has spent $400,000 on research to develop

Q62: Explain how the firm apportions risk and

Q64: Which type of bankruptcy involves a business

Q65: ADK Industries common shares sell for $40

Q69: A capital budgeting method that converts a

Q72: Regarding dividend payment procedures,which of the following

Q73: When calculating the component cost of equity,what

Q78: Which of these is a situation that