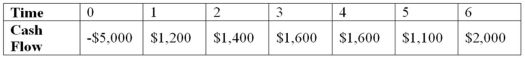

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

White House Press Secretary

The designated spokesperson for the President of the United States and the White House within the executive branch.

Amos Kendall

An early American journalist and politician, known for his role as an advisor in Andrew Jackson’s kitchen cabinet.

Andrew Jackson

served as the seventh President of the United States, known for his populism and for implementing policies that forcibly removed Native Americans from their lands.

Hill & Knowlton

A global public relations company known for providing strategic communications advice and services.

Q3: Suppose that Psy Ops Industries currently has

Q23: The Modigliani-Miller (M&M)theorem states that:<br>A)in an efficient

Q37: Explain what a PI of 35.23 percent

Q76: The study of the cognitive processes and

Q82: Suppose a firm pays total dividends of

Q95: In M&M's perfect world,their theorem's two main

Q102: If a firm has a cash cycle

Q104: Which of the following is a measurement

Q105: Portfolio Return The following table shows your

Q105: An estimated WACC computed using some sort